JUNE BROUGHT THE GLOOM OF KATE SPADE-GLORY FOR MUSIC AND MORE

FASHION

LVMH’s Next Generation Seeks Change

Content Courtesy of: businessoffashion.com

Written By: Carol Matlack and Robert Williams

Editors: Anne Swardson, Phil Serafino

The multipronged group has shaken up its ranks of managers and designers, rolled out new e-commerce platforms and become a patron of the French technology scene.

Bernard Arnault, chairman of LVMH at his office in Paris

Photo by: Magali Delporte

PARIS, France — At last week’s Louis Vuitton menswear show in Paris, newly hired designer Virgil Abloh sent hoodie-clad models down the runway toting duffel bags made from gleaming high-tech plastic, all to the latest Kanye Westalbum. West, who embraced the tearful designer as he took his bows, was joined by his wife, Instagram super-influencer Kim Kardashian. Seated steps away: Bernard Arnault, head of parent company LVMH, and four of his adult children.

The duffels, embossed with the LV logo, were a far cry from the monogrammed brown bags that helped LVMH define and dominate the global luxury industry. They’re just one of the many ways the company is remaking itself as the next generation of Arnaults carves out a greater role. Of Bernard’s five children from two marriages, all but the youngest one hold senior positions at LVMH.

Over the past year, the multipronged group has shaken up its ranks of managers and designers, rolled out new e-commerce platforms and launched a makeup line with the singer Rihanna. It’s become a patron of the French technology scene, subsidising workspace at a startup incubator and handing out awards to young entrepreneurs. Such moves contrast with LVMH’s long-time modus operandi of acquiring iconic European brands and enhancing their exclusivity.

“Luxury companies are required to engage the consumer in ways they never did before,” said Mario Ortelli, who runs a London-based advisory firm on luxury strategy. “It’s become more of a collaboration” as the response on social media can either boost or sink new collections. The younger Arnaults, Ortelli said, “can look at this market with the eyes of someone who is closer to it” than their 69-year-old father.

“Such moves contrast with LVMH’s long-time modus operandi of acquiring iconic European brands.”

Abloh’s hiring illustrates the transformation. A Ghanaian-American streetwear designer, he was a creative consultant to West when he was spotted by Delphine Arnault, 43, Vuitton’s executive vice president, and Alexandre Arnault, 26, head of the Rimowa luggage business. Abloh, who studied architecture rather than fashion, has a following of 2.6 million fans on Instagram, many of them willing to pay as much $2,500 for a pair of sneakers from his collaboration with Nike.

“What’s exciting about him is his approach, and the fact that he’s so open to the world,” Alexandre Arnault said before the show, standing on the rainbow-painted runway. In a nod to LVMH’s success with classic fashion, he added: “It’s about redefining the codes of luxury, making it more accessible for young people. The products will stay exclusive even if the approach is inclusive.”

Bernard Arnault doesn’t plan to retire for at least a decade, according to people familiar with his thinking, and there’s no clear front-runner to replace him. But as his children expand their influence, and as the serial deal-maker runs out of companies to buy, LVMH is reshaping the brands it already owns. It’s all with an eye to making them increasingly relevant to a generation of consumers more excited by Instagram posts and sneaker drops than by the editorial pages of Vogue. Arnault, the chief executive officer, declined to be interviewed.

The luxury business “is not about It bags anymore,” said Federica Levato, a partner at Bain & Co. in Milan. “Streetwear, T-shirts, puffy jackets, are becoming an important part of the core collection.” In marketing to these customers, luxury houses have to focus not only on products but also on “communication, visuals, social media, all the touchpoints.’’

The company, 47 percent owned by the Arnault family, posted 43 billion euros ($50 billion) in sales last year, nearly three times the figure of its nearest competitor, Kering. Its portfolio of 70 brands, from Vuitton and Dior to Moet & Chandon Champagne and Tag Heuer watches, turned in robust 13 percent sales growth during the first quarter. Bernard Arnault is the world’s sixth-richest person with a fortune of $73 billion.

While LVMH doesn’t break out sales for individual brands, Louis Vuitton is the world’s largest and most profitable luxury brand, with sales of nearly $11 billion and an operating margin of 45 percent last year, according to HSBC. Shares of the parent company are up about 16 percent this year.

“Bernard Arnault has a sixth sense about what’s next” in luxury trends, said Ron Frasch, a former president of Saks Fifth Avenue who now works in private equity at Castanea Partners in New York.

“LVMH can no longer count on acquisitions to supercharge growth.”

Still, there are worrisome signs. Gucci, owned by Kering, is outpacing LVMH in the race for younger customers — an urgent concern, as 85 percent of growth in the luxury sector now comes from shoppers under age 38, according to Bain. Designer Alessandro Michele has rebooted Gucci with collections that pile on crystals, embroidered flowers, dragons, and cartoon cats. Gucci, which says 55 percent of its sales are to millennial shoppers, reported revenue up 49 percent in the first quarter of this year. That compares with 16 percent at LVMH’s fashion and leather goods division, dominated by Vuitton.

LVMH can no longer count on acquisitions to supercharge growth. Starting in the late 1980s, Arnault snapped up dozens of mostly family-owned companies — fashion houses, watchmakers, champagne growers, and more — scaling them up and finding new markets for their products in the developing world, especially in China.

Nowadays, there are few opportunities for game-changing deals. The family owners of Hermès, the high-end handbag maker, rebuffed Arnault’s efforts to build a stake in the company. The owners of privately held Chanel show no interest in selling, either. Arnault’s last big acquisition, in 2017, was essentially a bookkeeping exercise: He spent about 12 billion euros to buy out minority shareholders in Christian Dior, which he already controlled, and fold it into LVMH.

Arnault and his team used to be known as “killers’’ who stalked the luxury sector for potential acquisitions, said Gachoucha Kretz, a marketing professor at French business school HEC. Now, “they are taking another path.”

That path includes new management and design talent. LVMH recently replaced the longtime head of Christian Dior with Pietro Beccari, former head of the Fendi unit. Beccari won acclaim there for his e-commerce savvy and for whimsical spectacles that raised awareness of the fur-and-handbags brand. One example: a show in which model and reality-TV star Kendall Jenner appeared to walk on water as she traversed a plexiglass runway over Rome’s Trevi Fountain.

And the family has hired Hedi Slimane, the star designer who set the menswear agenda for more than a decade when he brought back skinny jeans and suits at Dior Homme in the early-to-mid-2000s. Slimane is set to show his first collection at Céline in September.

Abloh, whose appointment was announced in March, caught Delphine Arnault’s attention in 2015 when she made him a finalist in an annual competition to spot promising young designers. Delphine has become LVMH’s chief scout when it comes to design talent. She’s also inherited for father’s penchant for quality control, popping in unannounced at some of LVMH’s more than 4,000 stores around the world to make sure they’re up to snuff.

Abloh is “a completely different generation,” said Takashi Murakami, who worked with Vuitton on a series of multi-colored handbags in the early 2000s during the brand’s first conversion from stuffy trunkmaker to veritable fashion brand under Marc Jacobs. “When I was collaborating the first time with Marc Jacobs, at this moment the high fashion was the high fashion—-with very few black people. This time it’s really with the hip-hop movement.”

“As the younger Arnaults make their mark on LVMH, it’s likely the company will become more open and transparent.”

Chief executive Arnault has fast-tracked the careers of two younger sons from his second marriage. Alexandre helped seal the acquisition of Rimowa in 2016 and now runs the German luggage maker. Frederic, 23, became head of “connected technologies” at Tag Heuer last year after graduating from the elite Ecole Polytechnique, his father’s alma mater. The youngest, Jean, is still in school.

Alexandre Arnault has pushed LVMH to step up its digital efforts and helped persuade his father to bring aboard Ian Rogers, a former Apple executive, as the company’s chief digital officer in 2015. “Alexandre has been a big part of raising the importance of digital,” Rogers said. “He’s part of start-up culture.” Alexandre also backed Abloh’s bid for a top job at LVMH, collaborating with the designer on a collection of transparent suitcases that Rimowa sold for nearly $1,000. And it was Alexandre who accompanied his father on a New York trip to meet with President-elect Donald Trump at Trump Tower in early January 2017.

LVMH’s track record on e-commerce is mixed. Although some businesses, such as Vuitton and Sephora, have successful online boutiques, other efforts have stumbled. ELuxury, an online designer site, shut down in 2009 after failing to gain traction. Last year LVMH launched an online boutique and mobile app called 24 Sèvres, inspired by the group’s Left Bank department store Le Bon Marche. It has struggled to catch up with online luxury leaders such as like Net-a-Porter and Matchesfashion.com.

As the younger Arnaults make their mark on LVMH, it’s likely the company will become more open and transparent — a change that CEO Arnault acknowledged in a company memo naming his 41-year-old son, Antoine, as communications director in early June. “LVMH’s success attracts growing attention from the media, observers, public authorities, as well as the general public,” he wrote. Such openness could give LVMH greater name recognition outside France. Many of its customers have no idea that businesses ranging from Glenmorangie whisky to the Sephora cosmetics chain are owned by the group.

The senior Arnault still dictates strategy. At headquarters on Paris’s swank Avenue Montaigne, “to discuss anything important you have to go to the seventh floor,” where the chief executives’s office is located, said Ashok Som, who teaches luxury management France’s Essec business school. And why shouldn’t he call the shots? Said Som: “He started this whole industry.”

MUSIC

Content Courtesy of: nytimes.com

Written By: Ben Sisario

New Way to Pay Songwriters and Musicians in the Streaming Age Advances

From left, songwriters Kay Hanley and Michelle Lewis, with Dina LaPolt, a music industry lawyer who said the Music Modernization Act “is going to revolutionize the way songwriters get paid in America.”CreditCody James for The New York Times

For a decade, the music industry has promoted a motley series of copyright bills to Congress, only to watch them fail.

In an effort to update music copyright law for the digital age, the various players involved — tech companies, music publishers, songwriters, musicians and radio broadcasters — assembled an ambitious bill that addressed their concerns.

On Thursday, in a sign that their work is paying off, the Senate Judiciary Committee discussed the matter in some detail and voted in favor of the bill, the Music Modernization Act.

“This is going to revolutionize the way songwriters get paid in America,” said Dina LaPolt, a lawyer who has been one of the music industry’s most aggressive supporters of the bill.

The bill is meant to correct the flaws and loopholes that have led musicians to complain about unfair compensation from streaming services, while also protecting companies like Spotify from lawsuits. It also establishes a truce between music publishers and digital music services over an aspect of licensing that has led to a string of multimillion-dollar lawsuits.

For years, songwriters and music publishers have argued that streaming services have routinely failed to properly acquire mechanical licenses — the permission to reproduce a piece of music for sale or consumption, a term that goes back to the days of player pianos. At the same time, Spotify and other companies said that there was no authoritative database identifying who owned what.

David Israelite, the president of the National Music Publishers’ Association and one of the main drivers behind the bill, said that the prospect of continuing litigation brought the tech companies to the table.

“I have no doubt that we could have sued them out of existence,” Mr. Israelite said of streaming services. “But we took a different approach. We decided that we wanted to settle this and try to fix the problem, because we want them to be our business partners.”

Lobbyists said they were confident the bill would be passed by the full Senate, and eventually become law, despite concerns raised by a few senators at the hearing. A version of the bill passed the House unanimously in April.

The legislation would establish a licensing collective, to be overseen by songwriters and publishers, and paid for by the digital services, with rights information maintained by the copyright owners. Digital services, which now must track down rights holders or file notices in bulk with the Copyright Office, will be able to receive blanket licenses from the collective. In exchange, the services will gain protections against lawsuits.

In a lawsuit filed late last year, for example — just before a cutoff date set by the bill — a music publisher representing songs by Tom Petty, Stevie Nicks and others sued Spotify for $1.6 billion over licensing lapses. Under the Music Modernization Act, the licensing collective would serve as a one-stop shop to obtain those rights.

Some Republicans on the Judiciary Committee, including the Texas senators John Cornyn and Ted Cruz, expressed reservations on Thursday about a collective established by the government rather than the free market, but still voted in favor of the bill.

Christopher Harrison, the chief executive of the Digital Media Association, a group that includes Google, Apple and Amazon, said that the new process would remove the bad faith that has existed between music publishers and streaming services.

“I describe those conversations as like the end of a Tarantino movie, where everybody is pointing guns at each other and claiming it’s the other person’s fault,” Mr. Harrison said. “We had a number of really frank conversations with publishers, saying, ‘Let’s get past who is to blame and figure out how to solve the problem.’”

A critical element of the bill would allow musicians to be paid for digital plays of recordings made before 1972, which are not covered by federal copyright. At a Senate hearing last month, Smokey Robinson called that rule unfair. “An arbitrary date on the calendar,” he said, “should not be the arbiter of value.”

The bill also includes two provisions favored by Ascap and BMI, the industry’s two biggest royalty clearinghouses, over the complex procedures used to set royalty rates in federal courts.

Both groups, which are governed by federal regulations, would be able to introduce new kinds of evidence in court. Those trials are now overseen by a pair of federal judges whose decisions are endlessly scrutinized for clues about future cases; under the Music Modernization Act, the cases would be randomly assigned to a pool of judges in United States District Court for the Southern District of New York, which the bill’s backers argue would make the process more fair.

The Music Modernization Act combines parts of several proposals made over the last year. But some parts of the legislation have been proposed before in separate bills, most of which collapsed from disputes among warring factions of the music industry.

“Congress was getting tired of us coming to them with narrow fixes,” said Daryl Friedman, the chief advocacy officer of the Recording Academy, the organization behind the Grammy Awards.

Although lobbyists agreed on a compromise bill that has broad support, one long-sought change to copyright law — the ability for performers and record companies to be paid when songs are played on terrestrial radio, in addition to songwriters — was sacrificed to gain support from broadcasters, who for decades have bitterly opposed such a change.

The bill does have its detractors, including publishers that did not want to relinquish the right to sue digital services. Christian Castle, a lawyer and blogger who is often critical of Silicon Valley, said the bill also does not adequately provide for the costs of setting up a comprehensive rights database.

“It is a phenomenally huge undertaking which has befuddled everybody,” Mr. Castle said, “and there is no process for it.”

A report by the Congressional Budget Office in April, prepared for the House version of the bill, estimated the cost of establishing the licensing collective at $47 million.

If it goes through, the bill is likely to bring about the most sweeping changes to music copyright law since the passage of the Copyright Act of 1976.

“Just pulling us into this century is going to be super helpful for the future,” said Michelle Lewis, a Los Angeles songwriter who three years ago helped start an advocacy group, Songwriters of North America.

ADVERTISING AND BRANDS

Content Courtesy of: nytimes.com

Written By: Jonah Engel Bromwich, Vanessa Friedman and Matthew Schneier

Kate Spade, Whose Handbags Carried Women Into Adulthood, Is Dead at 55

The American fashion designer was found dead in her Manhattan apartment on June 5, 2018. Ms. Spade was known for her bold, colorful and classy aesthetic. She was 55.

Buying a Kate Spade handbag was a coming-of-age ritual for a generation of American women. The designer created an accessories empire that helped define the look of an era. The purses she made became a status symbol and a token of adulthood.

Ms. Spade, who was found dead on Tuesday in what police characterized as a suicide by hanging, worked as an editor before making the leap to designing, constructing her first sketches from paper and Scotch tape. She would come to attach her name to a bounty of products, and ideas: home goods and china and towels and so much else, all of it poised atop the thin line between accessibility and luxury.

One of the first of a wave of American women to emerge as contemporary designers in the 1990s, Ms. Spade built a brand on the appeal of clothes and accessories that made shoppers smile. She embodied her own aesthetic, with her proto-1960s bouffant, nerd glasses and playful grin. Beneath that image was a business mind that understood the opportunities in building a lifestyle brand, almost before the term officially existed.

Her name became shorthand for the cute, clever bags that were an instant hit with cosmopolitan women in the early stages of their careers and, later, young girls — status symbols of a more attainable, all-American sort than a Fendi clutch or Chanel bag. Ms. Spade became the very visible face of her brand and paved the way for female lifestyle designers like Tory Burch or Jenna Lyons of J. Crew.

“Kate Spade had an enviable gift for understanding exactly what women the world over wanted to carry,” Anna Wintour, the editor in chief of Vogue and artistic director of Condé Nast, said in a statement.

Ms. Spade, 55, was discovered dead at her Manhattan apartment, where she had hanged herself in her bedroom, the police said. The New York police chief of detectives, Dermot F. Shea, said the death was “a tragic case of apparent suicide.”

A police official, speaking on the condition of anonymity, said that a note found at the scene addressed to Ms. Spade’s 13-year-old daughter indicated that what had happened was not the child’s fault.

“We are all devastated by today’s tragedy,” the Spade family said in a statement. “We loved Kate dearly and will miss her terribly. We would ask that our privacy be respected as we grieve during this very difficult time.”

Andy Spade, her husband, later said that Ms. Spade had sought treatment for depression, adding that it had been severe at times. The couple had been living apart for 10 months but remained close, he said.

Kate Spade in her showroom in 1999.

Credit by: Marilynn K. Yee/The New York Times

Katherine Noel Brosnahan was born in Kansas City, Mo., on Dec. 24, 1962. Her father worked in construction while her mother took care of her and her five siblings. She did not grow up obsessed with fashion — though she enjoyed combing through her mother’s jewelry drawer — and early in life thought about being a television producer.

While a student at Arizona State University, where she studied journalism, she worked in a motorcycle bar and a men’s clothing store. There, she met her husband-to-be, the brother of the actor and comedian David Spade. She graduated in 1985.

After graduation, Ms. Spade moved to New York, where she became an assistant fashion editor at Mademoiselle magazine. Within five years she was the accessories editor. While in that role, she became frustrated by the handbags of the era, which she found to be gaudy and over-accessorized. What she wanted was “a functional bag that was sophisticated and had some style,” she later told The New York Times. She founded Kate Spade with Mr. Spade and a friend, Elyce Arons, in 1993.

Joe Zee, the former creative director of Elle and former fashion director of W, met Ms. Spade before she had started her company.

“She told me she was thinking of starting a handbag line in that carefree, excited way she had,” he said. He recalled her spirited manner, the way she always spoke colorfully, “with excitement and a smile.”

“And as a kid starting out in fashion, that was something you remember especially when everything was so serious and all about deadlines and the pressure of perfection,” he added.

Ms. Spade did not know what to call the company at first and decided to make it a combination of her and Andy’s names. (The couple married in 1994.) After the first show, she realized that the bags needed a little something extra to catch people’s eyes. She took the label, which had originally been on the inside of the bag, and sewed it to the outside. With that gesture she created a brand identity and sowed the seeds of her empire.

Julie Gilhart, then the fashion director of Barneys New York, picked up the label for the department store in the early 1990s. It was a great success. “It was so fast-growing,” she said.

The mid-′90s were “the time of the handbag,” Ms. Gilhart said, and Kate Spade was able to bring bags to young women whose budgets were not yet at designer levels. “Kate and Andy always had their thumb on the pulse,” she said. “They put their passion into an opportunity.”

Within a few years they had opened a SoHo shop and were collecting industry awards: Given a rising-talent award by the Council of Fashion Designers of America in 1995, Ms. Spade was named its accessory designer of the year in 1997. She was named best accessories designer at the Accessories Council’s ACE Awards in 1999, the same year the Spades sold their shares of the company to the Neiman Marcus Group. The year before, it had $28 million in sales.

Kate and Andy Spade during a party in Central Park in 2003.

Approachability was her calling card, whether she was making bags, clothes (which her company later expanded into) or books.

“She was a style icon,” said Ira Silverberg, who asked the Spades to do a book while he was working at the literary agency Donadio & Olson. “But I thought they were really accessible people, and when I got to know them, I realized they were.”

The series of books they worked on together — little gift items issued in 2004 as guides to “Style,” “Manners” and “Occasions” — were a hit, selling hundreds of thousands of copies.

She and Mr. Spade understood “how to reach an audience without alienating a consumer,” Mr. Silverberg said.

“Katie’s from Kansas City — a quintessential American look and values personified everything they did,” he added.

Ms. Wintour said in her statement that when Ms. Spade started her label, “everyone thought that the definition of a handbag was strictly European, all decades-old serious status and wealth.”

“Then along came this thoroughly American young woman who changed everything,” she continued. “There was a moment when you couldn’t walk a block in New York without seeing one of her bags, which were just like her: colorful and unpretentious.”

The company the Spades founded changed hands over the years. Neiman Marcus Group sold it to Liz Claiborne Inc. in 2006. By 2017, when Kate Spade & Company (as Liz Claiborne Inc. came to be known) was acquired by Coach Inc., Mr. and Ms. Spade had left more than a decade earlier to devote themselves to other projects.

Ms. Spade’s husband and daughter, Frances Beatrix, are her immediate survivors.

Ms. Spade dedicated herself to philanthropy through the Kate Spade & Company Foundation, which promotes economic equality for women. In 2016, with her husband, Ms. Arons and Paola Venturi, a Kate Spade alumna, Ms. Spade launched a new venture, an accessories label called Frances Valentine. She was so committed to the project that she added Valentine to her name.

Mr. Zee said he had always admired Ms. Spade for being ahead of her time.

“She knew what the fashion world needed before we did,” he said. “Kate just did what she felt was right, regardless of what the industry would think.”

INNOVATION

Content Courtesy of: usnews.com

Written By: Andrew Soergel

Countries Try to Lasso Cryptocurrencies

Governments will need a steady hand to better protect crypto investors without stifling innovation.

In the past several months alone, bitcoin, among the most popular cryptocurrencies on the market, has lost more than half of its value, with the price of one coin dropping from nearly $20,000 to fewer than $7,000. The downturn is believed to be weighing on the fledgling digital investments as a whole, with other mainstream cryptocurrency options such as Ethereum suffering similar losses as lesser-known upstarts such as VeChain waver but to a much smaller degree.

But such regulators walk a fine line in caging – or at the very least restraining – a class of cryptocurrency assets that have been heralded for their opaque decentralization, relative anonymity and versatility. The drive to at least partially corral the industry is driven in part by its rapid growth in popularity, say analysts: Born out of the blockchain technology, experts estimate the global cryptocurrency industry, even in the midst of its recent downturn, could soon approach $1 trillion in valuation.

“There’s a big dance going on right now, and that’s a dance between regulators and the public,” says Robert Wolcott, a professor of innovation and entrepreneurship at Northwestern University’s Kellogg School of Management. “You want to be seen as protecting the public. But at the same time, you don’t want to go so far that you obviate economic activity.”

The flurry of regulatory activity seen around the world in the aftermath of bitcoin’s initial rise has been difficult to ignore. Venezuela announced plans to roll out its own oil-backed cryptocurrency, which, if successful, could potentially help it circumvent international sanctions. Officials at a March summit of leading and developing nations called for international regulatory proposals to be submitted for consideration by mid-year.

Even the U.S. Securities and Exchange Commission has begun taking action, earlier this year issuing a round of subpoenas in an effort to ferret out fraudulent initial coin offerings.

“These markets are new, evolving and international. As such they require us to be nimble and forward-looking; coordinated with our state, federal and international colleagues; and engaged with important stakeholders, including Congress,” SEC Chairman Jay Clayton and Commodity Futures Trading Commission Chairman J. Christopher Giancarlo wrote in a January op-ed published by The Wall Street Journal – appropriately titled “Regulators Are Looking at Cryptocurrency.”

China, meanwhile, has gone out of its way to restrict cryptocurrency’s expanse within its borders, banning initial coin offerings, limiting energy-intensive bitcoin mining operations and blocking residents’ access to foreign crypto exchanges. The goal appears to be limiting Chinese exposure to the inherent financial risk that comes with such a nascent industry, though Chinese officials have expressed at least some openness to the assets, laying out national standards that are expected to be finalized by the end of 2019.

In mid-June, the China Electronics and Information Industry Development research institute – which falls under the country’s Ministry of Industry and Information Technology – also unveiled an index that essentially ranks the value the organization sees in a variety of cryptocurrency assets. EOS and Ethereum placed first and second, respectively, while bitcoin ranked 17th.

“We’ve really seen people step up in a few different directions. One is ‘We’re going to shut it down for awhile.’ That’s China, South Korea,” Wolcott says. “Regulators are trying to figure out what the political structure within their country or jurisdiction wants to see and why – and what is also going to be most effective in the long run from an economic perspective for their society.”

But international government officials face a slew of challenges – not the least of which is the difficulty in categorizing cryptocurrencies as a whole under an individual asset class.

“When you stand back, that starts to look a little bit like crowdfunding. They’re not giving you any equity,” Wolcott says. “Regulators have a standard that if it looks, feels and acts like an investment, then we have to start thinking about it like a security, even if it’s a utility token.”

The CFTC’s Giancarlo touched on this dilemma during a February hearing before the Senate Committee on Banking, Housing and Urban Affairs. He noted that several types of cryptocurrencies have “characteristics of multiple different things,” according to CNN Money, and that it would be difficult for the SEC or the CFTC to individually swoop in and broadly regulate the entire market.

“What we will do and what we are doing is looking for fraud and manipulation. And we intend to be very aggressive,” Reuters quoted Giancarlo as saying.

Because of the sheer number of new cryptocurrencies that have cropped up in recent years – the most popular of which are bitcoin, Litecoin and Ethereum – and their fluctuating values, it’s difficult to reach an accurate estimate of just how much money investors have lost to theft and fraud. Ernst & Young earlier this year analyzed nearly 400 initial coin offerings and found that hackers and thieves were able to make off with more than 10 percent of funds raised – resulting in losses of hundreds of millions of dollars just within its sample pool.

Theoretically, a more active regulatory presence could help stem theft – and the use of cryptocurrencies in unlawful transactions. The “Silk Road” captured headlines several years ago as a marketplace for drugs and other illicit dealings through the use of cryptocurrencies such as bitcoin, which can in some instances be particularly difficult to trace to an individual buyer or seller on the “dark web.”

“The crypto sector – which is approaching a market capitalization of $1 trillion – is rapidly growing and this trend is only likely to gain momentum,” says Nigel Green, founder and CEO of the financial consultancy deVere Group. “As such, there needs to be a robust regulatory framework in order to protect both institutional and retail investors. It will also help combat illicit activity.”

But an enhanced regulatory presence could be a double-edged sword in that new rules risk scaring off investment and stifling innovation and creativity. Lower-regulation countries such as Switzerland and Liechtenstein and territories such as the Cayman Islands have increasingly tried to position themselves as crypto-friendly places for investment – offering traditional financial safe-havens a renewed flow of investment as regulators throughout North America and Europe have moved to crack down on tax evasion and an international sheltering of assets.

Switzerland has a unique position in the world by having a special regulatory structure for banking, Wolcott says. “It’s natural they would try to take a leading role. My personal opinion is it will benefit Switzerland quite a bit, and it also benefits the blockchain cryptocurrency markets quite a bit to have credible locations like that.”

Should the U.S. or any other major economy move too slowly in adopting reasonable regulatory barriers and clear rules, crypto investment may end up flocking overseas while U.S.-based operations struggle.

“We actually see increased regulation as a great thing. The challenge for entrepreneurs is the lack of regulation. If the market is uncertain and you don’t know exactly how to operate, you’re much less free to build the regulation that you’d like to see,” Galia Benartz, the co-founder and head of business development at Bancor, said in a recent interview on CNBC’s “Street Signs”. “We all know that’s good for the industry, good for the projects, and good for the space. And I think another really exciting thing about the accessibility of cryptocurrencies to the masses, to the public, is accountability and looking into the projects you want to participate in.”

It’s a particularly fine line for international regulators to walk. There are plenty of risks associated with being the last country to arrive at reasonable crypto regulations. But there are also risks associated with being the first ones to the party.

“An economy like the United States, like China, like the EU, like Japan, some of the larger economies, ultimately they’re going to benefit from this and people have to figure out how to deal with it if they want to do business there,” Wolcott says. “That said, they probably will forego some of the benefit by not being there early. They also forego some of the risk.”

As crypto regulation discussions move forward in the U.S., many expect a series of broad federal guidelines to help guide state-level policies that could end up varying widely across the country. California – which accounts for nearly half of the top 10 U.S. cities in terms of cryptocurrency holdings per person, according to a recent report from Smart Money – is already considered to be among the most crypto-friendly states in the country. And Arizona legislators earlier this year attempted to pass a bill that would have allowed residents to use bitcoin and other cryptocurrencies to pay their taxes – though the final version of that bill didn’t explicitly lay out an opening for crypto tax payments in the near term.

Still, concern has arisen among some international experts that greater cryptocurrency adoption – which would theoretically be facilitated by the perceived legitimacy of light regulatory frameworks – could disrupt long-established financial sectors. Christine Lagarde, the managing director of the International Monetary Fund, warned in September that cryptocurrencies could “give existing currencies and monetary policy a run for their money.”

“For now, virtual currencies such as bitcoin pose little or no challenge to the existing order of fiat currencies and central banks. Why? Because they are too volatile, too risky, too energy intensive, and because the underlying technologies are not yet scalable,” Lagarde said at the Bank of England Conference in September. “But many of these are technological challenges that could be addressed over time. Not so long ago, some experts argued that personal computers would never be adopted, and that tablets would only be used as expensive coffee trays. So I think it may not be wise to dismiss virtual currencies.”

Wolcott says he believes cryptocurrencies will “undoubtedly have an impact” on fiat currencies such as the dollar, which for decades has represented the world’s most dominant reserve currency.

But he says any potential significant shakeup is likely a ways off and those concerned about the dollar’s standing on the international stage have bigger things to worry about in the near term.

“There are so many other factors that are influencing and that will influence the value of the dollar relative to other currencies or stores of value in the world that the impact of cryptocurrencies is going to be relatively minor for at least the next three to five years,” he says. “If I had to worry about something with respect to the dollar and my options were a huge budget deficit and rising U.S. debt and cryptocurrencies, I can tell you that I’d be concerned about the debt.”

Content Courtesy of: news.artnet.com

Art Industry News: A Warhol Painting Is Now Being Sold in the First-Ever Blockchain Art Auction + More Must-Read Stories

Plus, the Whitney Museum will be open seven days a week in July and August and ArtPrize is becoming a biannual event.

Andy Warhol, Self-Portrait in Fright Wig (1986)

Photo by: The Andy Warhol Foundation

Art Industry News is a daily digest of the most consequential developments coming out of the art world and art market. Here’s what you need to know this Friday, June 22.

NEED-TO-READ

What Oprah’s Museum Show Gets Right – A new show at the Smithsonian’s National Museum of African American History and Culture dedicated to the phenomenon and impact of Oprah Winfrey might have the appearance of pay-for-play, since the mogul donated $20 million to the museum. But Wesley Morris explains why the show is a deserved and dynamic tribute to the world’s most influential talk show host.

ArtPrize Goes Biennial – The annual prize will shift to a biannual schedule after its 10th edition this year; the 11th edition is slated for 2020. ArtPrize has also introduced a new biennial public art project in Grand Rapids called Project 1, which will debut in September 2019 and invite artists to respond to the city’s history and community. (Press release)

A Cryptocurrency Auction Is Selling Shares for a Warhol – The first blockchain art auction began on June 20, and a 1980 Andy Warhol silkscreen was up for sale. The work, 14 Small Electric Chairs, is being auctioned off in shares, with 51 percent of the painting remaining under the control of its current owner, gallerist Eleesa Dadiani.

Share Your Thoughts on David Hammons‘s Public Art – The proposal for a permanent sculpture by David Hammons called Day’s End on the Hudson River is now under public review, so members of the community have been invited to have their say. The work, an outline of a lost warehouse made in steel, will be overseen by the Whitney and is expected to cost around $5 million.

ART MARKET

On the Ground at Beijing Gallery Weekend – The second edition of gallery weekend in the Chinese capital took place this past March, with 22 participating galleries and more than 1,000 VIPs in attendance. Despite a housing crisis for artists and rapidly rising gallery rents, Beijing is giving Shanghai a run for its money as an international art and culture capital.

White Cube to Represent Park Seo-Bo – The veteran South Korean painter will now be represented by the international powerhouse gallery White Cube. The 87-year old artist is best known for his “Ecritures” series of paintings that feature pencil and oil on canvas.

Commercial Graffiti Is Good Business in Beijing – Graffiti is relatively new in the Chinese capital—but local street artists are quick learners. Graffiti artists are now taking on corporate clients to help produce and maintain their murals, an upstart business growing in tandem with the city’s rapidly commercializing art scene.

COMINGS & GOINGS

Wexner Center Names Deputy Director – Lindsay Cooper Martin, who has been the director of administration at the Hammer Museum in LA for the past three years, will take over the art center at Ohio State University beginning July 10. She succeeds Jack Jackson, who retired in April after a 13-year stint at the Wex.

Whitney to Open Seven Days a Week for Summer – The New York museum announced it will be open to the public seven days a week during July and August. (The museum is normally closed on Tuesdays.) This gives visitors more changes to see its summer exhibitions, including shows dedicated to Mary Corse and David Wojnarowicz.

Berlin Museum Gets Major Gift from Saudi Arabia – The charitable foundation Alwaleed Philanthropies, which is run by a Saudi royal, Prince Al-Waleed Bin Talal, is donating €9 million ($10.5 million) to the Berlin Museum of Islamic Art to support its operations, including an initiative to train Syrian and Iraqi refugees as museum guides.

Virginia Museum Director to Retire – Debi Gray, who has been executive director of the contemporary art museum since 2009, will retire in January 2019. “MOCA is on an upward trajectory with a skilled staff, a strong board, financial stability, and the support of the city,” Gray says. “We are poised to reach even greater heights.”

FOR ART’S SAKE

Top Clichés the Art World Loves to Hate – For a new group show at Almine Rech in New York, Rech and Bill Powers invited more than 40 artists—including Jeff Koons, Richard Prince, and George Condo—to contribute work that toys with the most common art clichés, from skulls to so-called “kid art.”

Photographer Busted for Passing Off Stock Photos as His Own – A Singapore-based Instagram star, Daryl Aiden Yow, has been called out online for photoshopping himself into uncredited stock images and implying in captions that he took the photographs himself. He has since apologized for misleading his followers.

Beijing Launches Art Museums Alliance – The Silk Road International Alliance of Art Museums and Galleries launched earlier this week as a platform for international institutions and galleries to communicate. The kickoff ceremony was attended by 24 museums from 18 countries as well as representatives from China’s Ministry of Culture and Tourism.

Anti-Trump Cartoons by Fired Cartoonist Are Going Viral – Political cartoons by Rob Rogers are making the rounds on social media after he was fired from a 25-year career at the Pittsburgh Post-Gazette for his unflattering portrayals of Donald Trump. In a recent interview, Rogers said: “You want to have as many voices as you can and they are starting to have only one voice of the paper, and I think that goes against what a free press is all about—especially when silencing that voice is because of the president.”

FOOD AND BEVERAGE

Content Courtesy of: foodbusinessnews.net

Written By: Jeff Gelski

Survey finds 80% of Americans want G.M.O. information on packaging

WASHINGTON — About 80% of respondents in an International Food Information Council Foundation survey said they would prefer to receive bioengineered/G.M.O. information on a product package. How the information is worded and what symbols are used could impact their views as well. The survey released June 27 may be found here.

The online survey contacted 1,002 Americans from the ages of 18-80 from May 18-27, or days after the U.S. Department of Agriculture in the May 4 issue of the Federal Register released a proposed rule for a National Bioengineered Food Disclosure Standard. The proposed rule may be found here.

The proposed rule uses the term bioengineered (BE) instead of genetically modified or G.M.O. Under the proposed rule, companies may disclose bioengineered food or ingredients in three ways: text, symbol, or electronic or digital link disclosure

When respondents in the IFIC Foundation survey were asked how they preferred to receive the legally required G.M.O. disclosure, 51% said a symbol or visual representation and 29% said text on a food package. Other responses were under 10% with send a text message to receive more information at 7%, visiting a web site at 6%, calling a phone number at 4% and scanning an electronic or digital link at 3%.

The U.S.D.A.’s proposed rule also gave three symbols that noted bioengineered (BE) food or ingredients: a logo with a smiling face, a sun logo with a smiling face and a logo with a plant. In the IFIC Foundation survey, the sun logo raised the smallest amount of concern about human health. Respondents also generally liked the smiling face logo. The plant logo was associated with greater concern for human health.

To further investigate how the form of BE packaging may affect views, respondents were shown different bottles of canola oil. When shown a bottle that had no BE logo or text, 31% had human health concerns. When shown a bottle that had one of three symbols (a plant, a sun or a smile), the percentage rose to 50%. When shown a bottle that had a symbol plus “bioengineered” in text, the percentage was 51%. When shown a bottle that had the plant symbol plus “may be bioengineered” in text, the percentage was 57%.

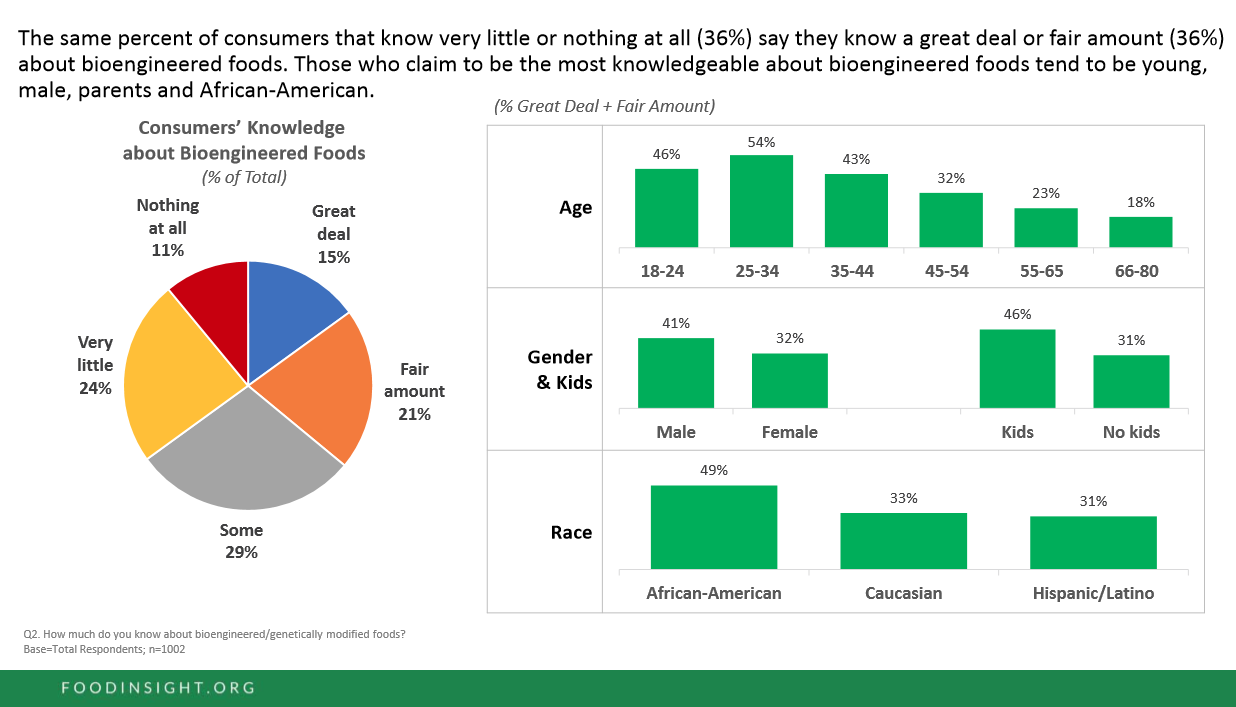

The survey also asked about knowledge of G.M.O.s, with 36% saying they knew very little or nothing at all about bioengineered ingredients or genetically modified foods and another 36% saying they knew at least a fair amount. People age 25 to 34 (54%) and African Americans (49%) were more likely to say they knew a great deal or a fair amount about bioengineered ingredients or genetically modified foods.

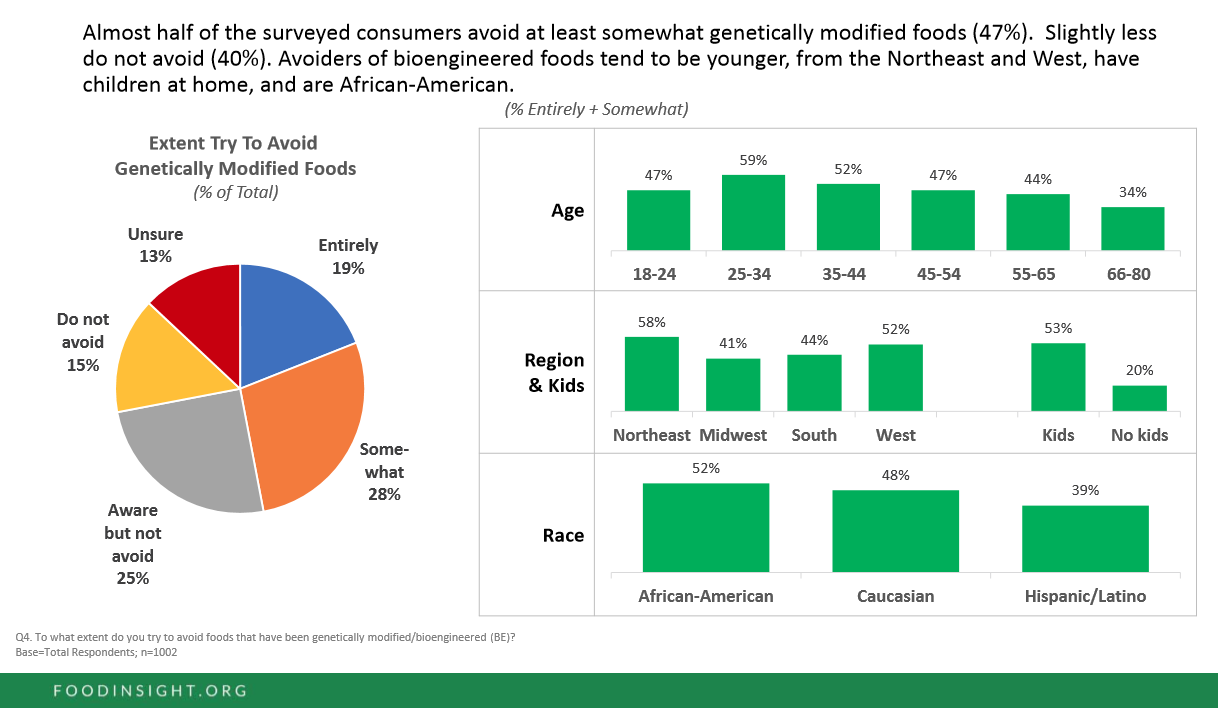

Nearly half (47%) of the survey respondents said they avoid G.M.O. foods either entirely or at least somewhat. People age 25 to 34 (59%) and African Americans (52%) were more likely to say they avoid G.M.O. foods either entirely or somewhat. Of those who avoid G.M.O. foods, 85% said it was because of human health concerns. Other top reasons given were the environment (43%), animal health (36%) and agriculture/farming (34%).

“Despite broad scientific consensus that G.M.O.s are safe to consume, a majority of Americans seem to be convinced otherwise,” said Joseph Clayton, chief executive officer of the Washington-based IFIC Foundation. “It’s a significant disconnect, and it underscores the need for more creative public education on the science behind our food.”